Before commencing with my article I’d like to wish everyone affected with the Corona Virus the soonest recovery and to whomever lost a person during the outbreak may their souls rest in peace. Hopes are that the whole recovers quickly and swiftly.

While the whole world is in its current cautious mindset in anticipation to where the Corona Virus pays its new visits, we cannot help but remember the words of Nassim Taleb in his New York Time Best Seller “Black Swan” as another “Big Short” window of opportunity opens up. As this highly improbable health event unfolds, it is clear that the stock market is already down and many are questioning the ability of the world and WHO in fighting this epidemic, soon to be pandemic.

High risk = high income and the exchange of ideas in this topic could actually be deemed inhumane, but the ongoing constant inflated discussions done by the media to resonate panic only begs that we speak about this with specificity.

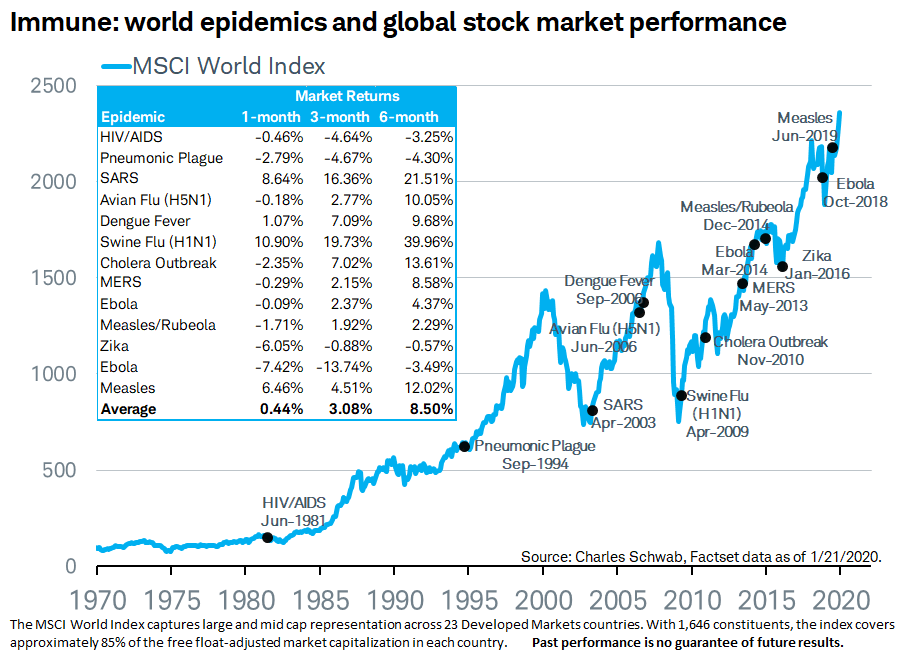

Let us start by maybe looking at some numbers for a fresh perspective:

Wuhan city is no.9 in terms of Chinese economy with almost $106 Million made in GDP. So up to today almost 81,279 people are infected worldwide & 2770 lost their lives. But, how bad is that? The death toll from the normal flu was 16,000 people per year in 2019. Is that how we are supposed to measure it? Of course not! Why? Because, our immune systems evolve year after year since the first outbreak in 1918. Wait but what were the numbers in 1918 for the first “pandemic”. 500 million affected, 50 million lost their lives out of a worldwide population measured to be 1.9 billion in 1917. That is 25% of the world population affected and a staggering 2% wiped off the planet. Compared to the corona virus which is 70,000 people infected, 2000 dead out of 7.7 Billion. In percent that is 0.0001% infected and 2.59 x 10^-6% deaths. Don’t get me wrong stay informed and cautious but don’t panic.

Back to our investment window. There are many assumptions made that could allow us to anticipate the prices of stocks in the near future. Tech titans in the states losing a staggering 200 Billion+ and the DOW Jones falling 1,000 points are all solid indicators that we are at the point of an economic situational temporary catastrophe. The gamble here is that with the information based on historical medical figures some pattern could be foreseen.

Industries mostly infected are the ones obviously impacted directly including healthcare & travel. From this perspective my fellow Millennials the panic is inevitable but as most pandemics, epidemics and plagues this too shall pass. So why not make some profits with our current and almost ridiculous savings? The question is when? As the whole world continues their blurry progress of their day to day activities it is safe to say that the investment could be done in the spring months as some news reports say that the first draft of the cure will be available in June or July of this year. Other sources say that this virus might die naturally in the summer as most viruses of the Corona family are not fans of the summer weather and need wind to be transmitted properly. It is also because people like to gather around in winter around a fire and feast while they escape the terrible weather. If the virus decides to take that pattern, the most expected recovery path of the stocks should commence mid June if not earlier and should recover fully by August.

Photo by Dimitri Karastelev on Unsplash